is interest on your car loan tax deductible

To do this you have to keep detailed records of these expenses and the miles you drive for business. The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Interest on loans is deductible under CRA-approved allowable motor vehicle.

.png)

. However for commercial car vehicle and. If this vehicle is used for both business and personal needs claiming this tax. The IRS allows you to deduct the interest you pay on a loan for your car provided the vehicle is used for business purposes.

Car loan interest is tax deductible if its a business vehicle. This means that if you pay. Reporting the interest from these loans as a tax deduction is fairly straightforward.

You cannot deduct the actual car operating costs if you choose the standard mileage rate. You cant get a tax deduction on interest from auto loans but mortgages and student loans do allow you to take a tax break under certain conditions. 50 of your cars use is for business and 50 is personal.

Tax-deductible interest is the interest youve paid for various purposes that can be subtracted from your income to reduce your taxable income. The standard mileage rate already. The interest you pay on student loans and mortgage loans is tax-deductible.

When claiming deductions of any kind on your tax returns it is best to keep detailed records and supporting documents that can be used to verify all expenses in case of. Interest on car loans may be deductible if you use the car to help you earn income. Only those who are self-employed or own their own business and use a vehicle for business purposes may claim a tax deduction for car loan interest.

So if you drive your car 50000 miles and 25000 of these miles are for. If you are an employee of someone elses business you are not eligible to claim this deduction. This is why you need to list your vehicle as a business expense if you wish to deduct the interest.

For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns. In addition interest paid on a loan used to purchase a car for personal use only is not deductible. For example if you use the vehicle 50 of the time for business purposes you can only deduct 50 of the loan interest on your tax returns.

May 10 2018. You can write off up to. Not all interest is tax.

In order to deduct the interest you must. F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500 in loan interest.

In addition interest paid on a loan thats used to purchase a car solely for. Experts agree that auto loan interest charges arent inherently deductible. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be.

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Is Buying A Car Tax Deductible In 2022

Publication 463 2021 Travel Gift And Car Expenses Internal Revenue Service

6 Surprising Tax Deductions For Uber And Lyft Drivers

The Best Auto Deduction Strategies For Business Owners Mark J Kohler

Car Loans For Teens What You Need To Know Credit Karma

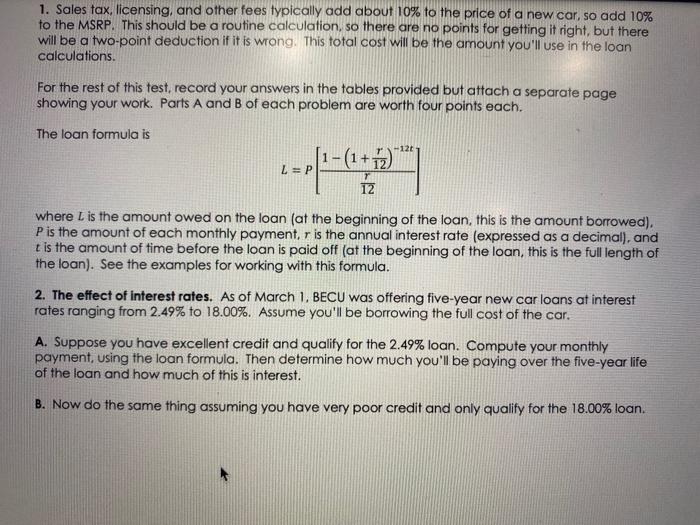

Solved 1 Sales Tax Licensing And Other Fees Typically Add Chegg Com

Is Car Loan Interest Tax Deductible Lantern By Sofi

Are Home Equity Loans Tax Deductible Nerdwallet

Enj Financial Tax Tip Tuesday Ask If You Can Deduct Your Interest On Your Auto Loan Need More Tips And Tricks On How To Save This Tax Season Check Us Out

What To Do When You Can T Pay Car Payment

Colorado Credit Union Auto Loans Bellco Credit Union

When Is Car Insurance Tax Deductible Valuepenguin

Car Leasing And Taxes Points To Ponder Credit Karma

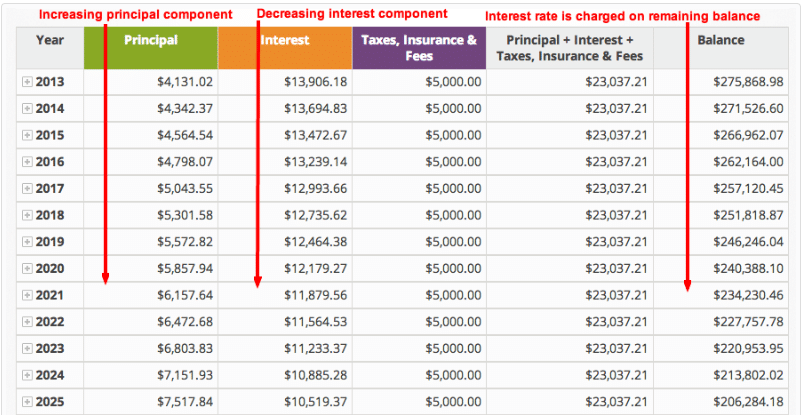

How To Calculate Amortization Expense For Tax Deductions

Tax Deduction For Business Use Of Your Personal Vehicle Googobits